Establish A Trust Today

Make sure you have a plan in place for the management of your estate after you pass away.

Experience You Can Trust

Death is a sensitive topic which Anderson handles with ease and respect. It is not easy to think about what is going to happen to your estate and your family after your death, but it is important to plan for this. At Anderson, we discuss with our clients what their current needs are, as well as their family’s needs after their passing. We understand every client is different and their estate planning needs are different. Whether you need a Will, Revocable Living Trust, or have other needs for your estate plan, we are here to help.

Request your FREE Strategy Session

“…They have taken the time to determine and tailor a plan to best protect me. Anderson Business Advisors are a must for your power team.”

Carlton L .

St. Louis, MO

THE ANDERSON ADVANTAGE

Preserve

Individualized tax planning empowers you keep to as much of your money in your pocket as possible.

Protect

Asset protection strategies and solutions to shield your assets and limit personal liability.

Prosper

Retirement, financial planning, and wealth management strategies to maximize what you already have.

What You Can Expect When Forming a Trust with Anderson

Death is a sensitive topic which Anderson handles with ease and respect. It is not easy to think about what is going to happen to your estate and your family after your death, but it is important to plan for this. At Anderson, we discuss with our clients what their current needs are, as well as their family’s needs after their passing. We understand every client is different and their estate planning needs are different. Whether you need a Will, Revocable Living Trust, or have other needs for your estate plan, we are here to help.

Learn More About Estate Planning

Frequently asked questions

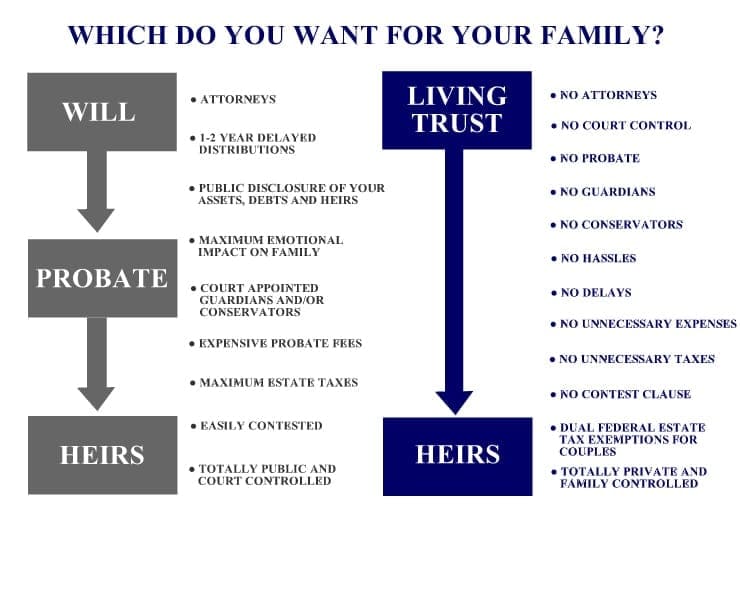

A will, also called a testament or a “will and testament,” is a legal declaration where a person, called the testator, names one or more individuals to manage the distribution of their estate and provides instructions for the distribution of their estate after their death.

Probate is a legal document, and receipt of probate is the first step in the legal process for the administration of the estate of a deceased person who had a will. Within probate, the court examines the will and resolves all creditor claims and distributes the assets of the deceased as deemed in the will.

One of the main differences between a living trust and a will is that with a living trust, your estate is not subject to probate upon your passing. The assets can be distributed without hiring any legal counsel. A living trust is not a matter of public record before or after your death, while a will becomes public record after your passing. If a living trust contains a pour over will, then the trust can take the place of a will.

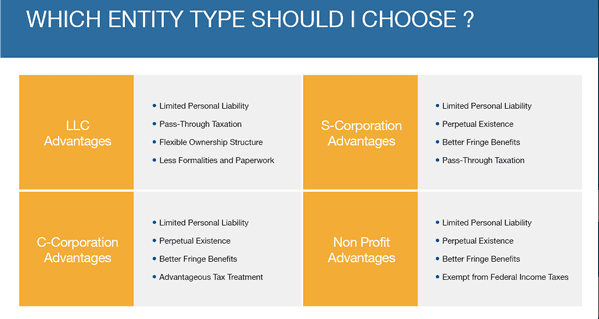

Your Custom Entity Blueprint

Speak with an Anderson Professional Advisor to get your business planning blueprint to determine the best entity structure plan for you and your unique situation.

Learning Pages

Anderson Advisors Glossary